Medicare and Women’s Health: What You Need to Know

Medicare coverage is available to most Americans age 65 and older, but health concerns and lifestyle conditions can be quite different between genders. Certain illnesses, normal changes with aging and even likelihood of visiting a doctor can vary widely, with differences showing up with regularity along gender lines. How are women different in how they age and how does this affect day-to-day healthcare?

Before we begin, it’s important to note that sex and gender exist on spectrums. However, this article primarily looks at cisgender (cis) men and women and the data that exists on aging and Medicare coverage for those groups. Being transgender or elsewhere on the sex/gender spectrum can affect life expectancy, overall health and experience of aging.

Next, we’ll take a look at how women age and their health, including Medicare’s role in supporting a vibrant life for decades!

Do Women Age Differently Than Men?

In short: Yes, women age differently than men, affecting the experience of aging as well as overall lifespan. Women live longer than men in almost every part of the world, and ideas abound about why that might be true. One theory is that females are more likely to visit a healthcare provider for preventive care or when something begins to feel wrong. This means there are more chances for medical problems to be diagnosed earlier, with better chance of recovery. This can explain some of the difference in life span, but there is more going on inside women’s bodies.

Some aspects of aging are experienced differently between the genders. In women, many significant aging changes happen in a short timeframe — over several years, rather than gradually for decades. As menopause arrives, the hormonal and physiological changes a woman experiences can feel dramatic — and they are! By the time most women reach Medicare age, menopause is complete and the swift dropoff in sex hormones is over and settled at its new lower level.

The good news is that once women are post-menopausal, the internal and external signs of aging slow down immensely until the end of a woman’s lifespan. On the other hand, men age gradually over many decades of adulthood, allowing the rates of aging between genders to eventually equalize — even shifting in favor of women as the years pass. This means that the aging and health of an 80-year-old man can be “older” than an 80-year-old woman.

Now that we understand the basics of how women age, let’s look at how Medicare can support a woman’s health.

Medicare and Women — the Numbers

When it comes to the demographics of Medicare coverage, there are noticeable differences between the sexes. Women make up 56% of Medicare enrollees overall, and 62% of Medicare enrollees over the age of 80. With women living an average of 5 years longer than men, this makes sense.

Despite the longer lifespan, women tend to have more chronic conditions than men. This means that women gain important benefits from the financial protection that Medicare helps to provide. In addition, women tend to have lower lifetime incomes and less access to pensions compared to men in our country. Both Medicare and Social Security are important ways that women increase their peace of mind in their later years.

Additionally, original Medicare does not cover many important services, such as dental and vision, home health services, nursing homes and even non-medically necessary foot care. For some women, coverage beyond original Medicare is the way to manage these normal health care expenses. The average woman on Medicare spends $4,490 each year in out-of-pocket costs, which can strain budgets and cause considerable stress.

The good news is that Medicare enrollees tend to have less problems paying medical bills than those who have stayed on private insurance. Medicare is a huge source of reassurance for millions of women (and men, too!)

When income is a challenge, many older Americans are dually-eligible for Medicare and Medicaid. Women are more likely to qualify for both, with a lower average income than men over age 65. Combining Medicaid and Medicare offers more coverage, right when it is needed.

Now, let’s look at the ways women can benefit from the coverage that Medicare offers, starting with preventive care.

Medicare Benefits Important for Women

Medicare can be an excellent resource for women through specific preventive coverage and benefits that help support well-being.

Preventive and Screening Benefits

Women are eligible for many preventive services and screenings that can help extend their healthy years and allow early treatment of more serious medical problems. Here are examples of covered preventive services that are available to women:

- Bone density screening for all women 65 and older (plus women 64 and younger who have gone through menopause)

- Breast cancer genetic screening test counseling for women at higher risk

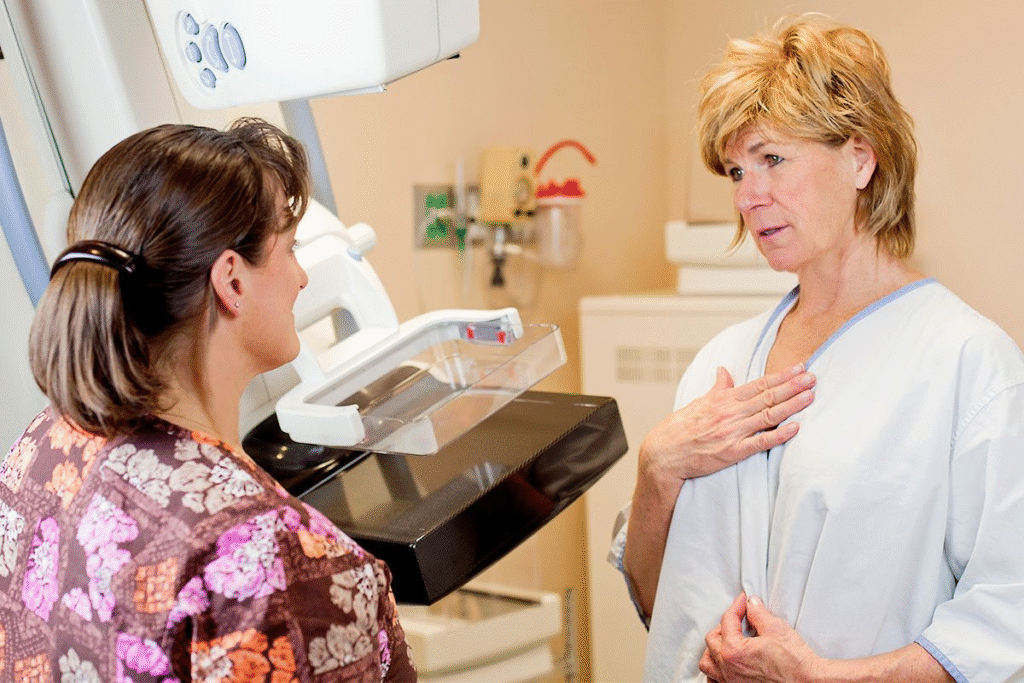

- Breast cancer mammography screenings every two years for women 50 and older

- Breast cancer chemoprevention counseling for women with higher risk

- Domestic and interpersonal violence screening and counseling

- Sexually transmitted infections counseling for sexually active women

- Pap test or cervical exam every 2 years for all women, or every year for women with higher risk

- Annual urinary incontinence screening

- Well-woman visits to get recommended services

Other Benefits Under Medicare

Original Medicare offers additional benefits beyond preventive care, like basic medical and hospital coverage. One overlooked benefit is the balance exam: a screening to identify any balance issues that might affect daily living or fall risk. Another is a hearing exam. It’s true that original Medicare does not cover hearing aids, but Medicare will cover your hearing test — if your doctor recommends it.

Because original Medicare has no limit on out-of-pocket spending and the percentage you will pay for covered services is 20% coinsurance, costs can add up quickly. It’s important to learn about coverage options, including those that will help to limit premiums and maximum out of pocket costs. Many women choose to add supplemental health coverage in the form of Medicare Advantage, Medicare Supplement or prescription drug coverage to help manage their costs.

Conclusion

The differences between Medicare-aged women and men’s health concerns are real. Understanding relative factors in health and illness for aging female bodies is crucial to long-term enjoyment of your retirement years.

We hope we’ve given you an overview of what you need to know about women’s aging and Medicare’s coverage for women. If you have any questions about Medicare or Medicare coverage as a woman, please feel free to give us a call. One of our PlanEnroll agents will be happy to help you.

Ede’m Now Health Marketplace is a brand operated by Integrity Marketing Group, LLC and used by its affiliated licensed insurance agencies that are certified to sell Medicare products. Ede’m Now Health Marketplace is not endorsed by the Center for Medicare & Medicaid Services (CMS), the Department of Health and Human Services (DHHS) or any other government agency.