How the Inflation Reduction Act Affects Medicare Recipients: The 5-Year Plan

The Inflation Reduction Act was signed into law in 2022 and set out goals for addressing health, tax and climate concerns. One of the biggest areas they are targeting is the growing issue of inflated prescription costs and particularly how those costs are affecting Medicare users. This legislation seeks to help regulate future prescription costs for Medicare users and to provide more affordable access to essential medicines, like insulin.

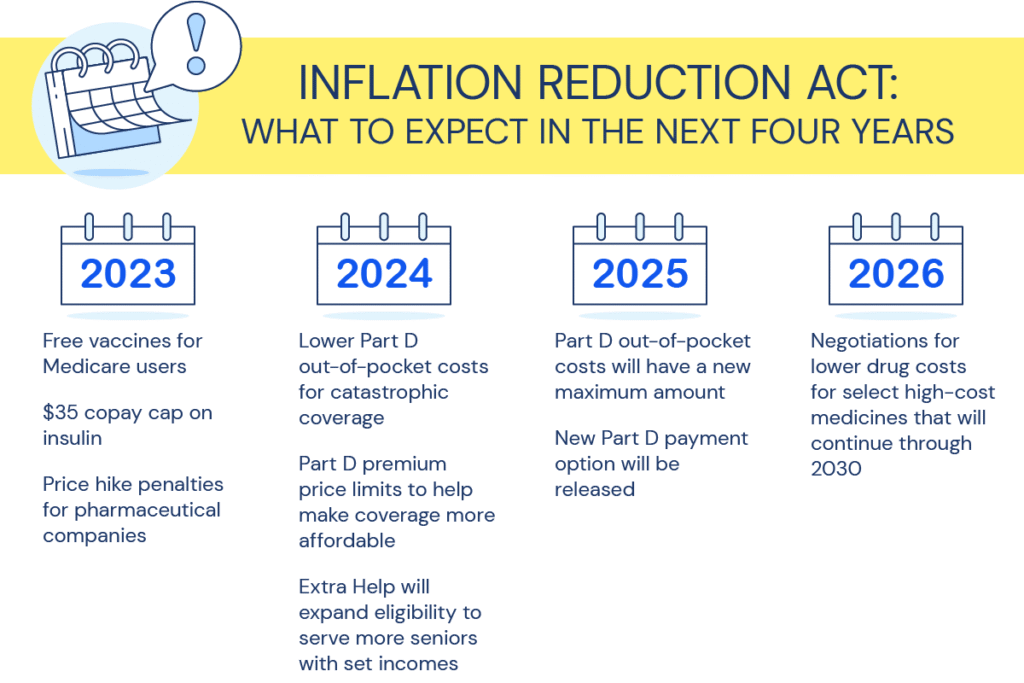

Let’s take a closer look at how the Inflation Reduction Act will impact Medicare users in the next five years (and beyond) as the legislation is rolled out.

What to expect in 2023

Free vaccinations

One of the biggest things from the Inflation Reduction Act going into effect in 2023 is that many vaccines will be free starting this January. Vaccines that are recommended for adults by the Centers for Disease Control (CDC) and Prevention’s Advisory Committee on Immunization Practices (ACIP) will become free for Medicare users, which includes vaccines for COVID-19 and shingles.

We created a post on our Learning Center going into more detail about this part of the Inflation Reduction Act, so go check it out!

Regulated insulin costs

Beginning in 2023 and extending through 2025, the copayment for a 30-day supply of Medicare Part D-covered insulin will be capped at $35. This copay amount will be the same even if you have not met your Part D deductible. Starting in 2026, insulin cost interventions will either be $35 or 25% of the medication’s negotiated cost, whichever is lower.

Insulin costs, which have skyrocketed in recent years, can be a huge financial burden for those with diabetes. This price cap will help more people afford their medicine and manage their blood sugar. Including insulin costs in the Inflation Reduction Act was a huge part of addressing medical inflation while ensuring Americans have access to this lifesaving treatment.

Price hike penalties for pharmaceutical companies

Part of the purpose of the Inflation Reduction Act is to crack down on pharmaceutical companies who have set unreasonably high prices on their medications. Beginning in 2023, penalties will be put in place for pharmaceutical price increases that exceed the rate of general inflation.

Companies that don’t comply with this legislation will have to pay Medicare a rebate for the amount their price hike goes above the inflation rate. This penalty applies to all Medicare sales of the drug as well, meaning repeated infractions could cost companies a lot of money.

What to expect in 2024

Lower Part D out-of-pocket costs for catastrophic coverage

Beginning in 2024, Part D plan members facing extremely high drug costs and entering the catastrophic phase of coverage will not face additional out-of-pocket costs for the rest for the year. Until this new rule goes into effect, the 5% copay for catastrophic coverage will remain.

Part D premium limitations

Starting in 2024 and extending through 2029, Part D plans cannot increase their premiums more than 6% per year. This is expected to help make Part D plans more affordable for those living on set incomes. After 2029, the Secretary of Health and Human Services will determine future premium growth limitations.

Extra Help financial aid expansion

Beginning in 2024, the federal government will be expanding the Extra Help eligibility threshold. This program assists seniors with limited incomes, such as those who rely on their Social Security checks, afford prescription drug costs. The income threshold to qualify for the program will jump from 135% of the federal poverty level to 150% to assist more seniors nationwide.

What to expect in 2025

Part D out-of-pocket cap

This first-of-its-kind limit will put a cap on the maximum amount people will have to spend out of pocket on their prescription drugs. The out-of-pocket cap will be $2,000 per year and will be the same for those purchasing Part D coverage separately or getting their prescription coverage through a Medicare Advantage plan.

A new Part D payment option

In 2025, Part D enrollees will have the option of spreading out cost-sharing payments over the course of a calendar year, which Medicare is calling “smoothed cost sharing.” This is designed to help protect Part D enrollees from receiving large drug bills all at once that could discourage or prevent them from filling or taking prescribed medicines due to financial constraints.

What to expect in 2026 (and beyond!)

Price negotiations to lower drug costs

Beginning in 2026, consumers will begin to benefit from price negotiations for the first ten prescription drugs under Part D that will be subject to negotiation. This is specifically for those drugs that have high costs and no alternatives. Biologic medicines fall into this category.

Each following year, the number of drugs negotiated will increase. 10 in 2026, 15 in 2027 and 2028, and up to 20 drugs in 2029. This means that nearly 60 high-cost prescription drugs will have negotiated better prices for Medicare users by 2030. Part B drugs (those typically administered at a hospital or doctor’s office) will begin price negotiations in 2028.

Conclusion

The Inflation Reduction Act is an exciting legislation designed to help alleviate some of the burden of high prescription costs for Medicare beneficiaries. In the next five years, new systems will be put in place to help make Part D prescriptions more affordable for seniors and to help regulate future drug costs.

Understanding these and other Medicare changes can help you best plan for your health coverage needs. If you have any questions about how your costs will be impacted, or to learn more about Part D drug plans, please reach out and speak to a licensed PlanEnroll agent.

Ede’m Now Health Marketplace is a brand operated by Integrity Marketing Group, LLC and used by its affiliated licensed insurance agencies that are certified to sell Medicare products.

Ede’m Now Health Marketplace is not endorsed by the Center for Medicare & Medicaid Services (CMS), the Department of Health and Human Services (DHHS), or any other government agency.